We were supposed to be writing about the advisers who have produced great video content this week. But, some changes at Unbiased, along with research we’ve pulled together, mean you will have to wait until next week for the third instalment of our content trilogy. It’s been around six weeks since Unbiased Response Ratings were launched to a mixed reaction from advisers.

If you’ve been hiding under a rock, we wrote about the new feature in an article which you can still read by clicking here.

The system is also explained on Unbiased’s website.

In our piece, we criticised Unbiased for launching the Response Rating system without the ability for advisers to temporarily set their profiles to ‘away’. Who wants to check their enquiries whilst they are on holiday or at the weekend? I certainly wouldn’t. Nor would I want my rating to suffer simply because I’m away.

I’m pleased to say this this facility has now been added to your dashboard. You can find it under Settings and then Enquiry Settings.

As we write, we’ve also noticed the Unbiased’s homepage has now been changed to give equal prominence to the directory and the ‘matching’ service. That’s another welcome change which should please advisers.

It’s good to see Unbiased listening to adviser feedback; let’s hope it continues.

So, how is the Response Rating working out?

We’ve been monitoring the Response Rating of several advisers (thank-you to those who have helped us do this) and the results are interesting.

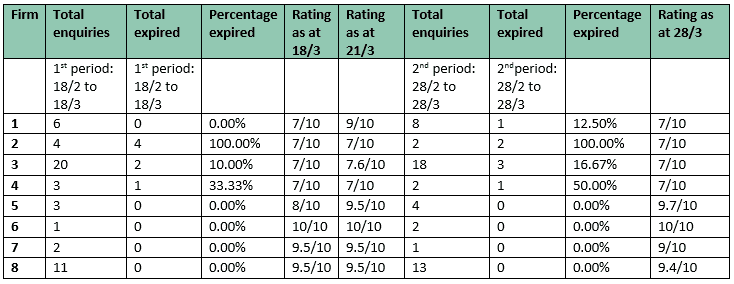

The table below shows anonymised data for eight firms. It gives their rating on 18th March, along with the data for the 30 days leading up to that date.

We then show how their rating changed on 21st March and again a week later on 28th March with the corresponding enquiry data.

The full table is shown below, it raises some potential anomalies:

- Firms 1,2,3 and 4 have let between 12.50% and 100% of their enquiries expire. Yet they all have the same Response Rating of 7/10

- Firm 1, on 18th March, had let no enquiries expire in the 1st period, yet had a response rating of 7/10, the same as firm 2, who had let all their enquiries expire. Firm 1, presumably because of their speedy responses, moved to 9/10 only to drop a week later, right back down to 7/10 after letting one single enquiry expire

- Firm 5 increased their enquiries by one in the 2nd period and their response rating rose to 9.7 / 10. However, firm 8, who had two more enquiries, saw their Response Rating fall slightly

- Firms 5,6,7 and 8 have let no enquiries expire. Yet they all have different Response Ratings

- We have also compared firm 6 with another, not on the table. Both have received two enquiries during the 2nd period, which were handled within 24 hours. Firm 6 accepted both, the other accepted one and declined the second. Firm 6 has a 10/10 response rating the other firm sit at 9.5/10. The only difference is that firm 6 accepted both enquiries and the second firm didn’t

We believe our research raises multiple questions about the Response Rating. Not least, how can the first four firms, who clearly respond to enquiries in very different ways, have the same Response Rating? And secondly, how can the final four firms, all of whom have let no enquiries expire, have different Response Ratings?

In the search for answers we have asked Unbiased the following questions:

- How often does the published Response Rating get updated? Is it real-time, updated daily or on specific days?

- What information is included in the algorithm? Are the only factors the 30-day period and responding to enquiries within the allotted 24 hours?

- Do advisers get more points for accepting an enquiry than rejecting one?

- What reason could there be for two advisers, who have exactly the same number of total enquiries and expired enquiries, over the same time period, to have different Response Ratings?

- Why do these firms 1,2,3 and 4 (in the above table) all have a response rating of 7/10 when their percentage of enquiries which have expired are so different?

Unbiased has told us they are “unable” to answer these questions, simply referring us to this page on their website:

If they change their mind and decide to respond (which we hope they do) we will of course update this article.

Why does this matter?

Simply because Unbiased is still regularly mentioned in the press, online and in many wake-up packs. It is still seen as a trusted way of finding a financial adviser.

It is also an important source of new enquiries for many advisers, which is why, for the avoidance of doubt, I still recommend advisers use it.

Consumers will use it too, as a way of differentiating advisers. As Unbiased said themselves when they launched the Response Rating: “Consumers will be able to view each adviser’s Response Rating on their Unbiased listing, which may help them make a decision about which adviser to contact. Advisers in turn can use this new feature to their advantage, as a high rating is another way to stand out in a competitive market.”

We will continue to monitor the same adviser profiles over the coming weeks and months, and update our table on a regular basis.

In the meantime, if you would like your profile added to the research (the bigger the data set the better) please do get in touch. We will treat the information you provide to us in the strictest confidence.