Thousands of advisers are listed on Unbiased and, despite increased competition in recent years, it remains the largest directory. Yesterday, Unbiased introduced a new adviser rating system. This is a fundamental change, which merits further explanation.

What’s changed?

Put simply, from 15th February, advisers will be rated out of 10.

The new adviser rating system, ‘Response Rating’ is generated automatically, not on consumer feedback, and is based solely on how quickly an adviser responds to enquiries.

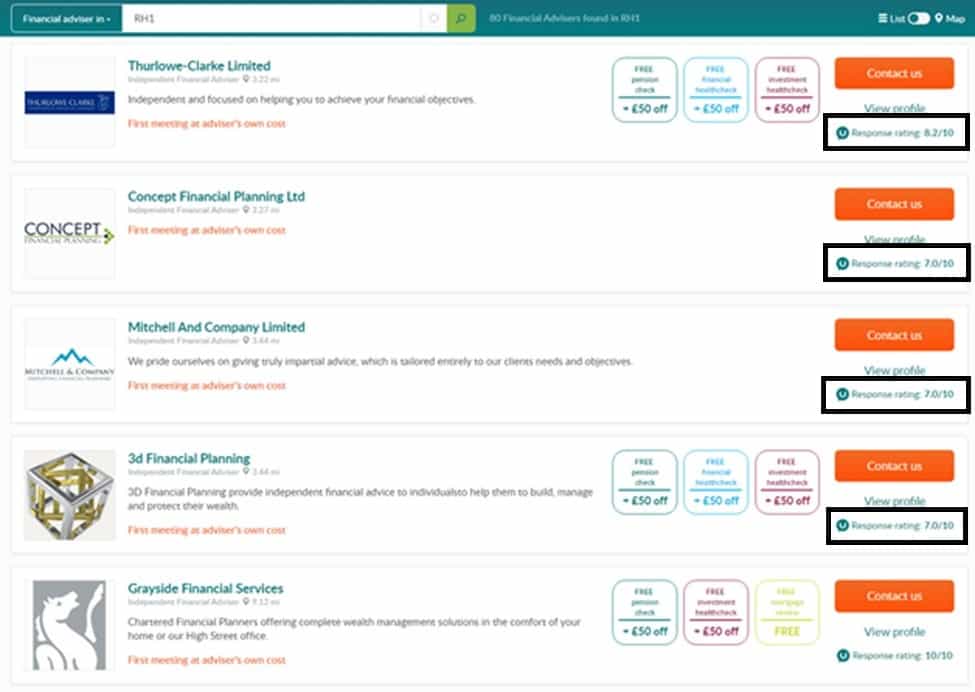

As the graphic below shows, the new adviser rating system will be displayed on the search results page and will undoubtedly be used by consumers when deciding which adviser to contact.

What affects your rating?

All advisers will start with a 7/10 rating.

Advisers who respond to an enquiry within 24 hours; either declining or accepting it, will see their rating rise.

Conversely, fail to respond to an enquiry within 24 hours, and your rating will fall.

Crucially, it’s an adviser’s reaction time which impacts their rating. Not the acceptance of an enquiry.

Why has the new feature been introduced?

Unbiased are clearly keen to pair as many consumers as possible with advisers; after all, that’s their business.

Advisers who fail to respond to an enquiry create two problems. Firstly, the consumer hasn’t been contacted. Secondly, Unbiased doesn’t know whether the adviser wants the enquiry.

The introduction of the new adviser rating system, ‘match’ enquiry, which has had many critics, was the first attempt at addressing these issues. The introduction of the ‘Response Rating’ is the next weapon to be deployed.

Michael Ossei, Head of Adviser Product and Services is on the record as saying: “Unbiased has already made great strides in improving the consumer journey, with a new system that can automatically match enquiries to the most suitable adviser, and this has significantly reduced waiting times. The Response Rating feature builds on that progress by encouraging some positive yet simple behaviours from advisers who list with us. Checking enquiries daily is an excellent habit for advisers to nurture anyway if they want to find the right kinds of clients, and there is a similar benefit to consumers if they are matched more quickly.”

What should advisers do?

If the online comments are representative, the change has not gone down well. It’s early days, but there’s no doubt it will be enough to push some advisers into cancelling their subscription; which is a shame.

I could be wrong, but I doubt Unbiased will change the new system. Therefore, advisers who remain need to make it work. To do so, I’d make a couple of recommendations.

Firstly, ensure that all enquiries are responded to within the 24-hour time-frame. That means staying on top of enquiries or delegating that task to someone within your business.

This is especially important when you are on holiday or during particularly busy periods. Currently, there is no facility to temporarily pause enquiries. This means that if you don’t respond to enquiries within the 24-hour time-frame, because you are on holiday, your ‘Response Rating’ will suffer. (Update: 17th February – I am informed that an adviser’s rating cannot go below 7/10. However, it can reduce from say 10/10, 9/10 or 8/10 if enquiries, for a period of time, are not responded to.)

I understand that this is something Unbiased is developing. It’s a shame it isn’t available now. Who wants to spend time declining enquiries whilst they are sat on a beach, or when spending precious time with family, simply to maintain a positive ‘Response Rating’? This is particularly unfair on smaller advisory firms, who don’t have support staff to deal with enquiries and may well see their ‘Response Rating’ drop as a result.

Secondly, I would suggest using this change as a trigger to review your Unbiased profile. I’d recommend logging in once a month, reviewing the competition by running dummy searches and amending your profile where necessary. In my experience, too many advisers build their profile and rarely, if ever change it; then wonder why the results they receive are poor.

Those advisers who accept and work with the new system, even if they disagree with it, will be rewarded with a higher score, providing useful further differentiation from the other advisers.

Do I still recommend advisers use Unbiased?

Yes, absolutely.

Whilst acknowledging the issues it needs to address, for example, the ‘matching’ system needs refinement and I’d like to see the ability to pause membership introduced quickly, I am still a big fan of Unbiased.

For most advisers, a well written profile will produce a steady stream of new enquiries. You’re not going to build a large financial planning practice on the back of Unbiased alone. But, as part of a wider strategy, it can work very well.

The new system clearly isn’t universally popular, but I suspect it’s here to stay. Advisers who continue with Unbiased therefore need to work with it. But, dealing with enquiries quickly (remember, they don’t have to be accepted to push up your score) is good practice.

And, whilst in a list of factors consumers should consider when choosing an adviser, speed of response isn’t even in my top three, the ‘Response Rating’ will provide advisers who accept and work with the new system, a further way to differentiate themselves.

I’d be happy to answer any questions or queries you might have on the new system. Feel free to leave a comment at the end of this article, email phil@theyardstickagency.co.uk or give me a call on 07785 284429.