We know many financial advisers/planners are frustrated by the length of time it takes to get results from their marketing efforts.

They do all the right things; writing good content, posting consistently on social media and sending monthly newsletters, but their audience isn’t biting. At best, that leads to frustration and perhaps unnecessary tinkering. At worst they put a stop to all marketing, never to return.

The problem lies in their expectations because they:

- Overestimate the proportion of their audience who are ready to take action, and

- Underestimate the time (and number of interactions) it takes for people to act.

So, in today’s blog, you’re going to learn:

- What we mean by “your audience”

- The proportion of your audience that’s ready to engage

- The lessons that teaches us and the implications for your marketing.

You have three audiences

Put simply, an “audience” is a group of people who have, to varying degrees, a connection with you or your business. There are three types we need to consider:

1. Linked Listeners

These are people who are already connected to you. For example, they might have:

- Previously made an enquiry

- Subscribed to your newsletter

- Attended one of your webinars

- Connected with you on social media

- Downloaded an asset or resource from your website.

That means you have their email address, or you’re connected on social media, both of which allow you to control when messages are delivered and received.

2. Secret Suspects

Your Secret Suspects are people who know you, but you don’t know them. Yet!

They’re in the shadows, slowly getting to know you by visiting your website, reading your blogs and social posts or listening to your podcasts.

3. Curious Consumers

Curious Consumers are aware they have an immediate or future need and might have already started to research solutions but, so far, you aren’t on their radar.

Intention to engage is probably lower than you think

As we said earlier, overestimating the proportion of audiences who are ready to engage leads to frustration among many advisers, planners and business owners.

So what’s the reality? What percentage of your audience are, at a given point in time, ready to buy?

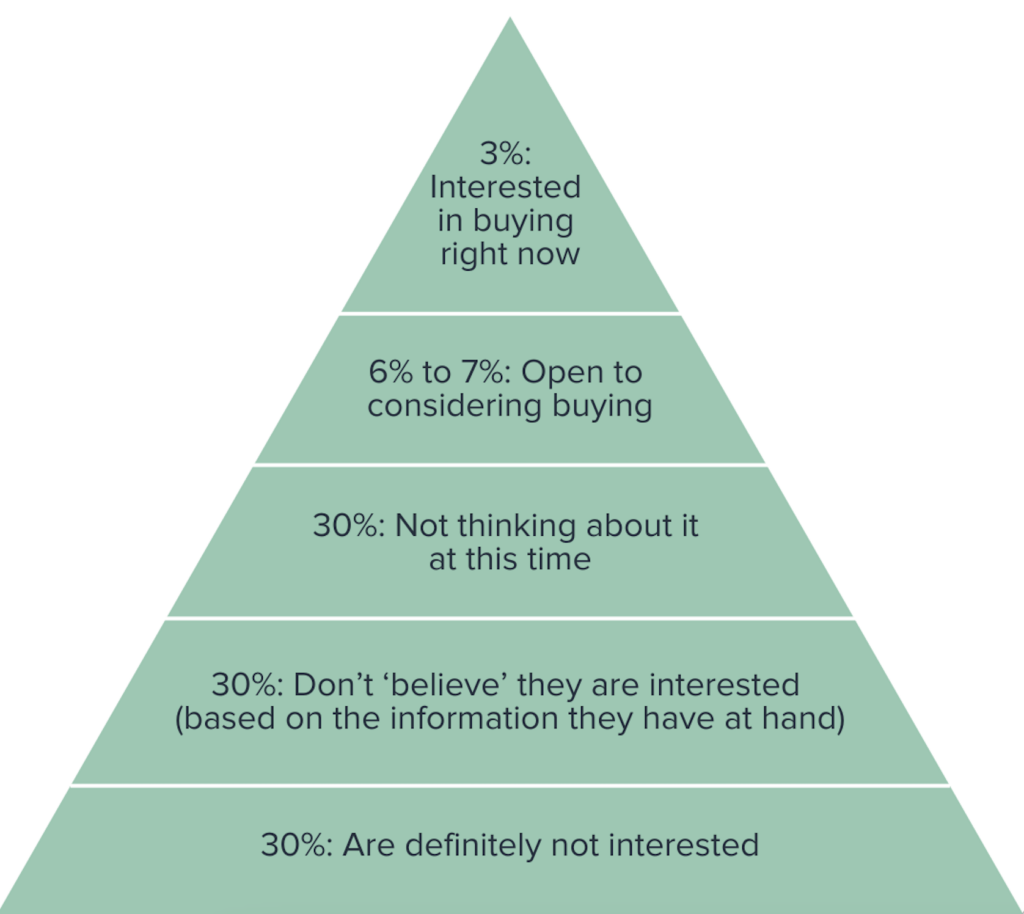

For the answer, we can look to Chet Holmes. In his book, The Ultimate Sales Machine, he suggests that at any given moment, only 3% of your audience will be ready to buy. These people are known as “in-market”. A further 6% to 7% are considering buying now, with the other 90% identified in his “Buyers Pyramid”, breaking an audience down as follows:

That 3% figure probably stings a bit. And it gets worse when we remember that not everyone in there will buy from you!

If you’re in the B2B space, for example, a financial planner who advises business owners, or a service provider selling into advisers/planners, things are a bit different.

You need to think about the 95/5 rule.

Research from Professor John Dawes of the Ehrenberg-Bass Institute shows that 5% of B2B decision-makers are ready to buy now. The other 95% might be months, or even years, away from buying or making a change to their supplier. And no matter how good your product or service is, they aren’t about to bring forward a buying decision.

3 implications for your marketing

So what does all this theory mean for your marketing?

We’ve identified three implications you need to consider.

1. Your expectations might need a reset

It doesn’t matter whether the number is 3% or 5%, I’ll bet it’s smaller than you thought it was, especially when we remember that not everyone ready to buy, will do so from you. And if you have unrealistic expectations, they’ll cause frustration and lead to short-term decision-making.

There’s a parallel here with how advisers/planners work with clients. If a client has unrealistic expectations of investment returns, they’ll get frustrated by periods of perceived poor performance. In turn, that could lead to them suggesting unnecessary changes, making their own fund switches or even moving to another adviser in the hope of better returns. In reality, all they need is education and patience.

The research from Holmes and Dawes shows the same is true when it comes to your marketing; some people need to dial down their expectations and dial-up:

- Patience

- Marketing consistency

- The time spent building, and nurturing audiences.

2. Calculate your required audience size

Understanding the proportion of your audience that might be “in-market”, allows us to reverse engineer a business goal into a required audience size.

Here’s how.

Let’s say a firm wants to take on £15 million of assets in the next 12 months.

On average, their clients each have £500,000, which means they need to take on 30 new clients.

We all know that referrals and recommendations are the best type of new enquiry. Currently, they have 220 clients and a Recommendation Rate (the rate at which their clients recommend them each year) of 20%. That means they can expect to receive 44 recommendations over the next 12 months.

They follow our advice and record the 12 data points we recommend for every new enquiry, so they know they have a 45% conversion rate on recommendations, which will lead to 20 new clients. Leaving them 10 short.

Their conversion rate for other enquiry types is lower, at 20%, which means they need 50 additional enquiries in the next 12 months.

Those enquiries will come from the three audiences we’ve previously identified:

- Linked Listeners

- Secret Suspects

- Curious Consumers.

It’s Linked Listeners though who are likely to be most engaged with the firm and, consequently, have the highest conversion rate. So that’s where we should focus our attention.

Taking our advice, they dial down their expectations and, rather than assuming 3% of their audience will buy this year, they set the number at 1%. That means to generate 50 enquiries, they need 5,000 people in their Linked Listener audience.

Right now, they don’t have that many, but there are plenty of things they can do to increase the number, including:

- Adding all new enquiries, including those who don’t immediately engage, to their newsletter database

- Running lead magnet campaigns on Facebook and LinkedIn (this is probably the fastest way to grow your audience of Linked Listeners)

- Using social media, particularly LinkedIn, to collect email addresses

- Running webinars (these always increase your number of Linked Listeners)

- Including a newsletter sign-up form on their website.

3. Develop a different plan for each audience type

As we said earlier, advisers and planners targeting consumers, as well as businesses supplying services to advice/planning firms, need to consider the needs of three audiences:

- Linked Listeners

- Secret Suspects

- Curious Consumers

Each audience needs a different strategy and that’s what we’re going to explore in next week’s blog.

Reality > perception

In the meantime, if the numbers we’ve shared with you today have been a reality check, please don’t be downhearted. It’s far better your marketing plan is based on reality and not a mistaken perception.

If you’d like to share your thoughts on today’s blog, please email phil@theyardstickagency.co.uk or call me on 0115 8965 300, I’d love to hear from you.