Online reviews will attract new clients to your business.

However, many advisers/planners don’t know where to start. Others worry that asking for reviews will damage client relationships.

So, in this definitive guide, we’re giving you all our knowledge about reviews in one place. It’s a detailed and practical A-Z of everything you need to know, based on our experience of helping hundreds of advisers, planners and firms collect more reviews.

Here’s what you’re going to learn:

- The 7 reasons why you need online reviews

- Why you need to collect reviews on two platforms

- The 3 things you can do to boost your review count

- How to write the perfect reply

- 3 mistakes to avoid

- How to reply to your reviews

- What to do when you get a fake or negative review

- How to get reviews back after Google has taken them down.

So, dive straight in.

7 reasons why you need online reviews

We believe every advice/planning business needs online reviews. Here’s why.

1. They impress prospects when they search for you online

After a potential client has become aware of you, perhaps after being recommended by an existing client or professional connection, they’ll probably search for you online. They might be considering other advisers/planners too, having sought a recommendation from more than one person.

When they search for you and the other firms, advisers, or planners they’ve been recommended to, what they see dictates who they choose to get in touch with.

To put it another way, you increase the number (and quality) of new enquiries if you impress potential clients on their digital journey to your door. If you’d like to understand more about how impressive (or otherwise) your firm is when someone searches for you, click here to take our free scorecard.

2. Evidence shows that potential clients value reviews

Research from BrightLocal shows that:

- 81% of consumers say that online reviews are either important or very important when deciding whether to use a particular company

- 87% of consumers used Google to evaluate local businesses in 2022 (up from 81% in 2021).

This evidence is supported by anecdotes from financial planners.

When discussing reviews, Tom Hatley of Christopher Little said on Twitter: “[Reviews are] usually in the top three things people check before getting in touch. They tell us they’ve checked out our reviews when we ask how they found us, although some freely volunteer the information saying that they read our reviews and are now calling for help.”

While over on LinkedIn, Simon Cutler said: “Almost 50% of our new enquiries are a result of a client reading our reviews after Googling/searching online for an IFA in their area. We wouldn’t be without them in our business.”

3. Google reviews help you to rank more highly in local searches

Despite the option of remote meetings, many people still prefer to work with a local adviser/planner.

Google reviews are a proven ranking factor and will help your SEO, particularly for local searches (“financial adviser near me”, “financial adviser in Brighton” and so on) and appearing in the Local Pack (the box below the adverts and above the natural search results).

4. They differentiate you from other firms

Your peers and competitors probably don’t have many reviews on Google or elsewhere. Taking reviews seriously, and putting the right processes in place, will help you stand out in a crowded field.

5. You will get ahead of the game

Less than perfect reviews aren’t always bad news; they show authenticity and allow you to learn.

However, a general lack of reviews means that poor ratings stick out like a sore thumb. In the unlikely event this is a problem for you in the future, building up positive reviews will help you get ahead of the game and show any issues were isolated incidents.

6. Ratings and reviews can be used throughout your marketing

You should increase the number of people who see your reviews by using them throughout your marketing. For example, embed them into key pages on your website, add them to your email footer, display them in your client newsletters, and slot them into your printed marketing literature.

7. Demonstrating the value of advice/planning

Some journalists and social media “influencers” are happy to spread myths and misconceptions about financial advice and planning.

So, while we need to acknowledge the bad eggs and do everything we can to root them out, we also need to shout about the successes. Collecting reviews is a great way of showing the benefits of financial advice/planning as well as your business.

Why you need to use two platforms

Hopefully, you’re now convinced (if you weren’t before) of the benefits to your business of having online reviews.

Next, we need to help you choose the platforms you should use to collect your reviews. You have several options, although there’s a simple logic that’ll help you choose.

As we said earlier, there are many ways potential clients become aware of you:

- They might be recommended by an existing client (always the best type of new enquiry)

- A professional connection could have pushed them your way

- They might have seen a social media post

- Or just driven past your office.

Google sits between prospects becoming aware of you and taking action (getting in touch) so most will look you up online before contacting you. Some want basic information such as your telephone number or email address, while others are doing deeper due diligence and comparing you with alternative options.

When they search for your business online, your Google Business listing should appear on the right-hand side of the results page. If your listing includes reviews, they will immediately impress potential clients at that very first interaction with you.

And that’s why (along with the other reasons we mentioned earlier) you should be collecting reviews on Google. But as you probably know, Google reviews aren’t easy to get:

- Clients need a Google account to leave a review

- Unless their Google account is under a pseudonym, their name will appear in public.

So, if the only review platform you use is Google, you’re sending clients down a dead end if they can’t or won’t use it. That’s not great and it’s the first reason you need two platforms.

The second reason is linked to how potential clients search for you online. As I said, some will search for your business, others will look up your name, for example, “Phil Bray” rather than “The Yardstick Agency”. If they do that, your Google reviews will not appear, and you’ve lost a chance to impress potential clients.

That means the logic of using two platforms is inescapable:

- It makes it easier for clients to leave reviews

- It means your business will collect more reviews, impressing more prospects on their digital journey to your door.

Over the years we’ve undertaken significant research into the review platforms available to advisers/planners. We concluded that in almost all cases VouchedFor should be selected as the review platform to partner Google.

There are several reasons for this:

- VouchedFor reviews appear when someone searches for an adviser/planner’s name, for example, Tom Hatley rather than Christopher Little. That nicely complements Google, where reviews appear when someone searches for a business.

- The cost of VouchedFor (£54 plus VAT per month) compares well to the fees charged by other platforms.

- The reputational tools provided by VouchedFor are excellent and help you to display your reviews elsewhere including on your website and social media.

- Although not its main purpose, VouchedFor will generate a small number of new enquiries directly from the platform each year. In our experience, the fees generated are usually more than enough to cover the monthly subscription costs.

- VouchedFor goes to considerable lengths to verify the authenticity of reviews. Prospective clients and advisers/planners alike can, therefore, be assured that reviews are genuine.

- VouchedFor’s Top Rated Guide, published each year, provides an invaluable promotional opportunity for the advisers, planners and firms who qualify. It’s worth noting that in 2024 the guide will be published in the Times as usual and also the Telegraph and Daily Mail.

In summary, firms should ideally use two platforms: Google and VouchedFor.

A three-step process for collecting reviews

We’ve been helping firms collect online reviews for nearly seven years and we have clients with more than 100 Google reviews and over 400 on VouchedFor.

These firms, often with our help, do three things:

- They run a booster project to immediately increase their review count

- Then they keep reviews topped up by following the process we explain below

- Finally, they look for other opportunities to add ad hoc reviews from clients, prospects, and professional connections.

We’ll now explain more about each of the three stages.

How to run an initial booster project

In our experience, most firms don’t have many reviews, so it’s important to start with a bang and immediately boost the review count.

To do this, you need to follow these simple steps:

- Set up your Google Business listing, if you haven’t done so already.

- Set up VouchedFor accounts for the advisers/planners in your team.

- Produce a list of clients you want to request reviews from (this list should include their “known by” name, surname, and email address).

- Write the email you will use to request the reviews. We recommend using one email, with two links, the first to Google and the second to the individual adviser/planner’s VouchedFor account (see below for an explanation of how to get these links).

- For efficiency, the email should be sent from a bulk emailing system such as Mailchimp or DotDigital, but made to look like it’s coming from the individual adviser/planner.

To make your life easier, we have a template email you can use. Click here if you’d like a copy.

How to keep reviews topped up

Keeping your reviews topped up after your initial booster project is important because:

- Prospects will want to hear from clients who have worked with you recently

- Regularly adding to your review count will help you catch up, or stay ahead, of your peers and competitors

- Your Google reviews are a ranking factor in local search

- The recency of your reviews is a significant factor in VouchedFor’s algorithm, which dictates where your profile ranks when people search for an adviser/planner on the site.

We recommend that review requests be sent:

- To every new client you take on

- After every review meeting you hold with an existing client.

The ideal process looks like this:

- The adviser/planner tells the client that they’ll receive a request for a review

- Assuming the client doesn’t object (which is almost unheard of) the adviser/planner should send one email, with two links, immediately when they return to the office

- That email should be wholly, exclusively, and only about reviews. Under no circumstances should it be about anything else

- You’ll get a better response rate if the adviser/planner sends the email, but if they are too busy (even though it only takes 30 seconds to send) someone in the support team can step in here to send the email.

As an aside, this is not the time for compliance to poke their nose in and request a client survey. After these key interactions (onboarding and annual reviews) your clients are feeling extremely positive about working with you, so you need to harness that by requesting feedback in public (through reviews) not in private (through a pointless compliance survey that they probably won’t fill in anyway).

Getting the links you need

To request reviews, you need three things:

- The email template we’ve produced (click here to request your free copy)

- A shareable link to leave a Google review

- A shareable link to leave a VouchedFor review.

Here’s how to get those two links:

To get the Google link:

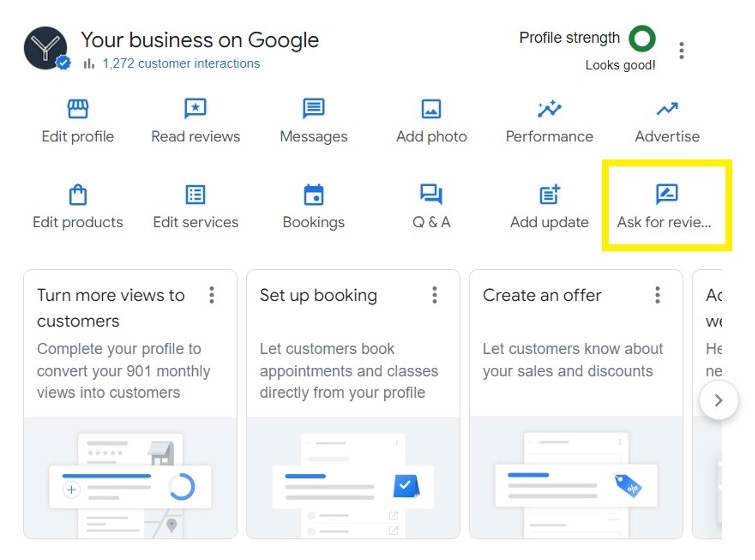

- Log into your Google Business profile, which will look something like the screenshot below

- Click “Ask for reviews”

- Copy the review link you are offered and paste it into your email.

Our Google review link looks like this:

https://g.page/r/CbhcLgvEYJm7EBM/review

Click it now to see how it works. While you’re there, if you like our blogs, webinars, and other free content, please leave a quick review!

VouchedFor

To get the VouchedFor review link:

- Go to your VouchedFor profile (there’s no need to log into your account)

- Scroll down the page until you get to the “Client reviews” section

- Click ”Leave review”

- Cut and paste the URL in your browser into the email template.

3 mistakes to avoid with your booster project and top-up requests

1. Only requesting Google reviews from clients who obviously have a Gmail account

Many clients will have more than one email address, perhaps including a Gmail address you don’t know about. Some will have a white-labelled email address (as we do at Yardstick). Others might love you so much that they’re prepared to set up a Gmail address specifically to leave you a review!

2. Excluding people who have already left you a review on VouchedFor

These people might still be prepared to leave a Google review and can also leave “top up” reviews on VouchedFor.

3. Asking advisers/planners to review the list of clients you’ll ask when you run a booster project

When firms have done this, we’ve seen relatively long lists reduced to almost nothing out of an abundance of caution from advisers/planners.

Spotting ad hoc opportunities

Most of your reviews will come from the booster project and then the change your processes to keep them topped up. However, you should also look for other opportunities to request reviews, including these five:

1. Asking to be paid with a Google review

This isn’t as daft as it sounds!

From time to time, you will speak with a prospective client who isn’t the right fit for your firm. Naturally, you want to be helpful and leave them with a positive impression of you and your business. So, you give them some time. You point them to alternative options. You give them other sources of information.

Now, here’s the clever thing.

Instead of putting the phone down and basking in the warm glow of your altruism, ask them to pay you for your time with a Google review. Grab their email address and send them the link.

Most will be grateful that you have spent some time helping them for free, and they will be very happy to leave a review.

Pro bono might not put money in your pocket, but it can build your Google reviews.

2. Turning unsolicited feedback into valuable Google reviews

From time to time, you and your team will receive an email from clients with unsolicited positive feedback.

The natural reaction is to reply to the client, say thank you and move on. If you do that, you’re missing out on an opportunity to boost your Google review numbers. Instead, change your reply to something along the following lines:

“Thank you for your feedback, it’s very much appreciated. I wonder if I could ask a favour; could you copy and paste what you said into a Google review? If you’re happy to do that (and absolutely no problem if you’d rather not), here’s the link you need <insert link>. Thank you again for your kind words.”

This works for two reasons. Firstly, the client is already thinking positively about you. Secondly, they don’t have to think about what to write (something that’s always a barrier with Google reviews). All they need to do is cut and paste what they have already written.

3. Printed postcards at client events

After the difficulties presented by Covid restrictions, we’re seeing more firms go back to running in-person client events. Whether it’s a golf day, investment briefing, or garden party, these are perfect opportunities to ask clients to leave you online reviews.

Try the two simple steps:

- Get postcards printed that include a QR code which opens a link to your Google and VouchedFor review pages.

- At your event, when you chat with clients or stand up to address the group, mention the postcards. Ask them to get their phones out, scan the QR code and leave you a review.

If your events are online, you can still do this.

Get a QR code, add it to a PowerPoint slide, and share your screen. Your clients can then scan it by holding their phone up to the screen and then head to Google or VouchedFor to leave you the review.

3. Use text or WhatsApp messages

Instead of requesting reviews by email, mix things up by sending your request by text message or WhatsApp.

- Evidence shows that open rates on text messages are significantly higher than for emails

- People respond to text messages more quickly than they do email

- Our research shows that around 80% of all advised clients regularly use WhatsApp. So, it makes sense to see if you can use both to get more Google reviews.

4. Ask professional connections for reviews

Professional connections introduce clients to you because they’ve seen the great work you do and trust you to do an equally good job for their clients. That makes them the perfect people to leave a review, yet most advisers/planners never think to ask.

So, next time you speak with one of your connections, ask them if they’d be happy to leave a Google review that explains why they introduce clients to you.

If they agree, follow up as soon as you can by sending the link by email, text message, or WhatsApp.

Replying to your reviews

There are five reasons you should reply to all your online reviews:

1. It shows you appreciate the review

The value of reviews to you and your business is huge. So, it’s important to show your gratitude.

Like us, most firms say thank you in private, usually by sending an email. However, replying to the review in public is more powerful because potential clients scrolling through your reviews will see it.

2. It shows you care about all clients

Very occasionally, an adviser/planner will receive a negative review. Often these are fake, but occasionally things have gone wrong, and the client has genuine cause for complaint.

Naturally, all negative reviews should receive a carefully crafted and appropriate response. However, it looks strange if you only reply to negative reviews. Instead, respond to all reviews (including “first impression” reviews on VouchedFor), both good and bad.

3. You’ll stand out further from the crowd

Despite the fact more advisers and planners are collecting online reviews, it’s still only a small minority who have a meaningful number.

It’s a smaller number still who actually write replies.

Advisers and planners tell us that competition rarely happens in a meeting room or on a Zoom call. However, we know that many potential clients consider more than one adviser/planner, checking them out online before deciding who to contact. So, by collecting reviews and replying to them, you will set yourself apart from your peers and competitors.

4. It allows you to deliver key messages

When you write a reply, you’re speaking to two people; the person who wrote the review and the potential client reading the review and your response.

Therefore, it’s the perfect time to work in some of your key messages. For example, if your client recently retired, talk about how financial planning gave them the confidence to stop working. If your client came to you worried about when they could afford to retire, and you’ve given them clarity about their future, explain how you did it.

Remember, potential clients want to know whether you’re the person who can solve their problems and help them achieve their aspirations. Your clients’ reviews and your responses are a great way to demonstrate that you’re the right person for them.

5. Adding keywords boosts your SEO

It’s not a silver bullet to endless enquiries (as some advisers and planners think it is) but there’s certainly value in appearing as high up as possible on the results page for local searches.

The reviews themselves will improve your SEO. And your reply is the perfect opportunity to work in keywords and phrases which will also boost your SEO.

For example, if you’re a financial adviser in Brighton, your reply might include: “There are many financial advisers in Brighton, and we’re delighted that you’ve chosen to work with us for the past 10 years”. Including that in your reply accomplishes several things:

- You’ve worked in some valuable keywords which Google will pick up

- You’ve told prospective clients based in Brighton that you’re local to them

- You’ve also told prospects that you form long-lasting relationships with your clients.

Your reply will be read by four audiences, each of whom is important in their own way.

The client who left a review: Perhaps the most obvious audience. Your client has taken time, and perhaps even signed up to Google, to leave a review. So, it’s important that they feel that you’re grateful. A heartfelt reply is the perfect way to do that.

Prospective clients: Potential clients will generally look you up online before contacting you. That means they’ll see your Google and VouchedFor reviews. Your replies are an opportunity to showcase your personality, explain the benefits of working with you, and get your key messages across.

Existing clients: When you ask existing clients to leave you a review, they will see your other reviews. Curiosity will take over and they’re bound to read some of them. This has two benefits for you. Firstly, the positive reviews reinforce the reasons they work with you. Secondly, the reviews will help to turn your clients into advocates who, in turn, are more likely to recommend you to others.

Google: As we said, when replying to Google reviews it’s important to include relevant keywords that potential clients might search for online.

3 steps to writing the perfect reply

As a rule of thumb, your reply should be 100 to 125 words long. That means they’ll take time to write, but it’s a worthwhile investment.

Step 1: Say thank you and use their name

Everyone likes to hear their name, so start your reply by giving a genuine and heartfelt thank you to the client for taking the time to leave a review, using their name.

Step 2: Tell a story to show benefits and achievements

You’re never going to reveal confidential information or break a client’s confidence. However, by referencing something they say in their review you’ll be able to explain the benefits of working with you.

Step 3: Include key messages

Potential clients will read your replies, which means you should work in the key messages you want them to hear, ideally linking them back to the client’s review. Depending on your service and proposition these could include:

- The benefits of financial planning

- How cashflow modelling gives clients confidence about their financial future

- How your fixed-fee structure will benefit them

- Why your Chartered status sets you apart

- The importance of independent advice

- The local nature of your service.

There’s plenty more. Mix them up too – you don’t want it to look like your replies have been cut and pasted!

Some examples to help you

It’s always easier to understand the theory of something when you see it in practice. So, we’ve chosen two random reviews (one each from Google and VouchedFor) and written replies, so you can see how to do it for yourself.

Google review:

“I was planning to retire early and knew I needed an IFA to plan for the future. Choosing an IFA was a critical decision and I came to Darren at <name of firm deleted> on the recommendation of a friend. I am very satisfied with the whole experience and recommend their friendly, supportive and professional service which has taken so much stress out of my financial decision-making.”

Suggested reply:

“Thank you, Jane, for your very kind review. You could have chosen any other financial adviser in Nottingham, so we’re delighted that you selected us. We understand how hard it is to compare financial advisers, and we’re delighted that your friend felt comfortable enough to recommend us to you. Hopefully, our Chartered status, plus the awards we have won, helped us to stand out too! We’re delighted that our cashflow forecasting gave you the confidence that you could afford to retire. We look forward to catching up with you soon and hearing about everything you’ve been up to! In the meantime, if you have any questions, we’re just around the corner, feel free to pop in at any time.”

VouchedFor review:

“What were the circumstances that caused you to look for a financial adviser? Initially a general financial review and advice regarding pension transfers with the aim of retiring early. Subsequent annual reviews, fine tune investment strategy and provide confidence everything is on track.

“How did Brian help you? Brian carried out a wide-ranging initial review and provided details on where savings could be made, and areas of risk to watch. For example, unnecessary insurance policies, investment risk management, better understanding of long-term wealth, and what would be required to live off etc. In particular, detailed pension review planning and consolidation. Have had several annual reviews since which fine-tune and adjust accordingly. When I have had ad hoc queries/advice, Brian has been pretty quick with responses and they are well thought through. Brian also looks at things from our perspective so I always feel that he is acting in our best interests.

“Have you seen the outcome you were hoping for? Yes, I have a much better understanding of investments and they are easier to manage. Retirement (or rather doing something different) can be brought forward. Ongoing management of investment portfolio has been easier and the annual reviews provide confidence all is OK.”

Suggested reply:

“Thank you, Sarah, for such a detailed and positive review. It’s very much appreciated. We know that deciding when to retire is particularly difficult for many people, so we’re delighted to have been able to help you achieve your goal of finishing work. You told us that the cashflow forecasting software we use gave you great confidence that you could afford to retire. I’m looking forward to seeing you enjoy your retirement years! I’m also really pleased that you’re happy with how quickly we respond to queries and that, by working together, you have a greater understanding of your financial affairs.”

What to do if a Google review vanishes

Unfortunately, Google reviews have a nasty habit of disappearing from time to time. In fact, there are 11 reasons why reviews might vanish.

Unhelpfully, Google doesn’t notify you when it removes a review or gives you the name of the person whose review they have taken down. So, you need to prepare for it happening by keeping your own records:

- Spot disappearing reviews by using a marketing KPI dashboard to monitor your review count (we have a free dashboard, click here to request your copy)

- Create (and keep up to date) a master list of all reviews including the name of everyone who left a review

- Take a screenshot of each review and save it somewhere safe.

When a review disappears, pull out your master list and search through it to identify the one that’s vanished.

Now, fight your corner by clicking here to submit an online form requesting that the review be reinstated.

In most cases, the initial request is met by a templated response from Google telling you that the review has been removed because it violates one of their terms of service. This is unlikely to be the case, so push back by:

- Explaining that the review is genuine and in no way violates Google’s policies

- Attaching a screenshot of the review to prove compliance

- Requesting that the review be reinstated.

In our experience, this is usually enough to persuade Google to put the review back. In the unlikely event, it isn’t, your master list means you know which review was affected, so you can go back to the client, explain what’s happened and ask them (very nicely) if they would mind leaving another review.

Dealing with negative reviews

There are two types of negative reviews:

- Fake reviews, left by people who aren’t clients

- Genuine reviews, left by an unhappy client.

If you get one of these, here’s what you should do.

Fake reviews

Very occasionally we see firms, and individual advisers/planners, fall victim to a fake review. If you’re a victim, you’ll naturally want to address the problem as soon as possible.

If this happens on VouchedFor their system should catch the review before it goes live. Alex Whitson, head of firm sales at VouchedFor, tells us: “If someone who is not a client tries to review an adviser, the adviser will have the ability to flag that before the review goes live. In this case, we would request evidence from the reviewer that they are a client. If they can supply this, the review stands. If they can’t, we remove it.”

Google is harder. We had a fake review last year, which we managed to get removed. It wasn’t easy though and I’ve seen other firms struggle to get fake reviews taken down.

If you’re unlucky enough to attract a fake review here’s what we recommend:

- Check your records to confirm that it is indeed a fake review.

- Leave a polite response questioning the authenticity of the review, explaining that you have no record of working with them and inviting them to contact your office to discuss their review.

- You then need to tell Google that the review is fake by clicking here to report it.

Again, it might take some back and forth with Google to get the review removed.

It’s also a good time to review your processes, and maybe run another booster project, to get more reviews which will:

- Push the fake review lower down your full list of reviews

- Increase your average score, which will probably have taken a hit as a result of the fake review.

Negative client reviews

We’ve never seen an adviser/planner receive a negative review after an initial booster project or following onboarding/review meetings.

All the negative reviews we’ve ever seen for advisers/planners (and there aren’t many) have been left proactively by clients. If you get one, here’s what you should do.

1. Take a minute

If you get a negative review, take a step back before doing anything. The temptation to start bashing out a reply (usually defensive and often unhelpful), might be overwhelming but knee-jerk reactions are rarely helpful.

2. Don’t get defensive

Easier said than done! Naturally, your first reaction is to defend your work. However, the reviewer might just have a point. Staying on the defensive means you’re not going to address their feedback effectively or learn from it.

3. Deal with criticism head-on

As hard as it is to do, never run and hide from criticism. Once you’ve taken a minute (you might need longer!) to collect your thoughts, develop a strategy for dealing with it:

- Put in a holding call or email to the client to acknowledge their criticism and confirm that you’re dealing with it

- Consider whether the client’s criticism is fair

- Ask the relevant members of your team for their view

- Go back to the client with your findings and apologise. Even if you don’t think you’re in the wrong, you’re dealing with their feelings and their reality. Then tell them what you plan to do and ask if they’re happy with that

- Consider what you should change in your business based on their feedback.

As we said, dealing with criticism effectively can turn an unhappy client into an advocate. That’s why you should always…

4. See criticism as an opportunity

Praise is great. It’s lovely to hear that you’ve done a good job for a client. However, it’s not as useful as constructive feedback, even criticism, because we can use that to learn and improve.

It’s hard to see criticism as an opportunity. I have a very thin skin when it comes to our work (it’s something I’m trying to improve!) because I know the blood, sweat, and tears our team puts into every client.

That said, we don’t get everything right and try to learn from all client feedback, which is why one of our core values is: “We give feedback constructively and accept it graciously; learning from it and incorporating it into our future work.”

So, if your client:

- Suggests your fees are too high; ask yourself whether you could communicate your value more effectively

- Questions investment performance; ask yourself what more you could do to communicate the value of financial planning

- Wants more communication between review meetings; ask yourself whether you should be picking up the phone more often or introducing other forms of communication such as newsletters.

5. Don’t let the thought of negative reviews stop you from collecting social proof

We’ve heard some advisers and planners say that they won’t collect social proof because they are worried about negative reviews. Once we’ve pulled a few locks of hair out in frustration we make three points:

- Your clients are probably very happy with the service you provide, it’s unlikely that you will get any negative reviews.

- Even if they do say something negative, wouldn’t you rather know what they were thinking rather than continuing in ignorance?

- If someone wanted to give you a negative review online they could do it easily enough now by visiting your Google My Business listing, signing up for a Trustpilot account and so on.

As Alex Whitson says: “Advisers should not fear negative reviews. They are rare in the advice space. And when they do happen, they can be turned into a positive.”

The positive benefits of social proof outweigh any potential negatives, which rarely happen. That doesn’t mean you shouldn’t be prepared, though!

If you get criticism on either Google or VouchedFor, start by working through the five steps we outlined above. Then, once the client is happy, ask them whether they still feel that the review reflects their current feelings. If they confirm it doesn’t, you might suggest that they amend the review, add a further comment, or remove it.

Naturally, there will be times when the review remains online, perhaps because you can’t solve the issue to the client’s satisfaction. In those circumstances, we recommend leaving a polite reply:

- Apologise, even if you don’t believe it’s your fault

- Acknowledge mistakes, don’t hide from them

- Don’t debate, there’s no point arguing about the facts in public

- Explain what you’ve done to address the problem, taking care not to reveal any personal information or break any confidences

- Note that the experience of this client is an isolated example and that your other clients are overwhelmingly happy. Use your online ratings and reviews as evidence

- Keep it brief – you’re not writing War and Peace. The response should be enough to satisfy the client, but (perhaps more importantly) the other hundreds or thousands of people who might read it in the months and years to come

- Sign off the review with a person’s name in your organisation whom the client (or anyone else) can contact if they have questions.

Alex Whitson again: “Writing a reply to a review is an adviser’s chance to demonstrate their personality and their commitment to great service. Put yourself in the shoes of someone comparing two advisers. Adviser A only has glowing reviews. Adviser B has mostly glowing reviews but one or two less positive ones, to which Adviser B has replied professionally and empathetically. Adviser B will often win.”

We’re here to help

We told you the guide was definitive!

If your business needs to get better at online reviews, but you don’t have the time, we’re here to help. If you’d like to know more, please drop me an email to phil@theyardstickagency.co.uk or call 0115 8965 300.