We know that financial advisers and planners change their clients’ lives.

We also know you’re extremely busy, so we’ll cut to the chase.

The Customer Duty deadline is looming large and want to do our bit to help. So, this week’s blog comes to you from Alex Whitson, Managing Director of VouchedFor, to share:

- The key challenges he’s been hearing from advice firms like yours

- Suggestions on how to work through these challenges

- Information about their platform, Elevation.

As always, we hope it helps, and our thanks to Alex.

We’ll see him again next week for our joint webinar, where we’ll be explaining how to appear in the 2023 Top Rated Adviser Guide.

If you haven’t registered yet, secure your place today.

See you there!

Over to Alex…

The FCA’s 31st October deadline to have a Consumer Duty plan in place is looming.

The good news is that data from our new Elevation platform shows most planners are doing a cracking job for their clients. Indeed, 99% of clients would consider recommending their adviser.

However, there are some important gaps when it comes to meeting the Consumer Duty rules. We’ve outlined six of the top Consumer Duty challenges we’re hearing from advice firms, along with how the data we’re collecting through Elevation could help.

What is Elevation?

A quick word on Elevation before we get stuck in. It’s a proposition distinct from the VouchedFor.co.uk website. Think of it like a much more powerful client survey. Fuelled by client feedback and cross-industry analysis, it shows advice firms the specific things they can do to improve client experience, meet the Consumer Duty and drive revenue.

Feedback captured through Elevation is private, unless the planner in question has a public profile on VouchedFor, in which case the relevant parts of their feedback would show on there as reviews.

The six top challenges

1. How can I evidence that my firm is doing a good job?

Importantly, the FCA is not saying that ‘cheapest is best’. It’s saying that whatever you charge, you need to be able to justify it.

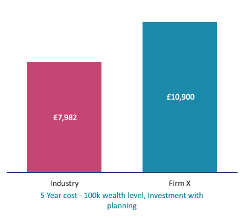

We recently spoke to a large advice firm which charges a premium vs the industry average. Across 5 years, for a client with £100,000 of investments, the firm charges 35% above the market average.

The senior team at the firm are confident they deliver a premium service, but are unsure how to demonstrate this.

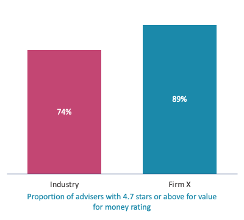

Elevation data shows that their clients feel they receive good value for money. In fact, 89% of their advisers are rated 4.7/5 or better for ‘value for money’, which compares well with 74% of the market as a whole.

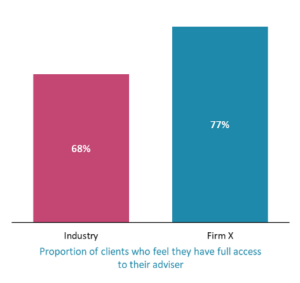

What’s more, compared to industry benchmarks, a higher number of their clients fully understand their level of risk and feel they have full access to their adviser.

These data points will help the firm prove to the regulator that they’re delivering great client outcomes.

2. How can we embed the Consumer Duty in our governance and culture?

For some firms, the biggest challenge is not collecting the data, but ensuring it drives decision-making at every level of the business. This is a key requirement within the governance section of the Consumer Duty rules.

Elevation dashboards are available at an adviser level. This gives advisers a view of how they’re doing, enabling them to address any issues quickly.

We’ve seen some great examples of firms using data to drive the right behaviours in their business. For example, MKC Wealth, a London advice firm, uses Elevation’s client advocacy scores to decide bonus payments (including the CEO’s) as well as training requirements and internal recognition awards

3. How can I monitor outcomes at every stage of the customer journey?

Most client surveys only go out to existing clients. This is a good start, but the FCA requires firms to monitor outcomes at every stage of the consumer journey, which makes the case for inviting feedback from prospects who may not go on to become clients.

Aside from the compliance benefits of this, Elevation data shows that it is a huge learning opportunity. 63% of prospective clients who leave a 5-star first-impression rating after an initial meeting tell us they intend to become a client. This more than halves to 28% if they leave a 4-star first-impression review.

In one instance, Elevation’s data showed a national advice firm that, for one of its advisers, only 5% of prospects intend to become clients; much lower than the 40% industry average.

Why was this? Well, only 25% of the prospects who met this adviser had in-depth discussions about the motivations for their goals; lower than the 34% industry average. Added to this, only 23% of these prospects understood the adviser’s fees; almost half the 44% industry average. Both these factors are important requirements within the Consumer Duty, as well as being big conversion-drivers.

4. How can I be sure that our clients really understand our communication?

The Consumer Duty requires advice firms to present information in a way consumers can understand. But it’s hard to evidence “understanding.”

The only way to be sure that your communications are clear is to ask your clients. So it’s no surprise that client feedback is one of the key data points that the FCA recommends firms collect.

But our 11 years’ experience collecting client feedback has highlighted the importance of asking the right questions.

For example, when we first asked prospective clients the question ‘Was the adviser clear about their fees?’ 89% said ‘Yes’. When we asked ‘How do the adviser’s fees work?’ and gave simple multiple-choice options, only 44% could give an answer.

5. How can I benchmark the experience of clients in vulnerable circumstances?

The new Consumer Duty requires firms to benchmark the experience of clients in vulnerable circumstances against that of other clients.

This is important, as Elevation data shows that clients with markers of vulnerability, such as low financial knowledge, give lower scores than clients with average or high financial knowledge across each of the four outcomes in the Consumer Duty.

For example, 4.2% of clients with low financial knowledge barely read correspondence from their adviser. This is four times higher than clients whose level of financial knowledge is average or high.

And yet many firms’ struggle to compare experiences across different client groups.

Elevation’s Consumer Duty Report gives 3 scores within each Consumer Duty outcome: all clients, vulnerable clients and industry average.

6. What system can I put in place to avoid foreseeable harm?

When dealing with multiple clients, it can be hard to identify those at risk of future harm.

For example, we work with a large firm with thousands of clients. In response to the question on clarity of communication, they found four clients who believed they ‘don’t receive any correspondence”. In fact, they had been sent correspondence by the firm but due to issues such as incorrect email addresses and spam filters, the clients’ perceptions were that they hadn’t received any.

In each case the firm was able to contact these clients and address the issue, before it escalated.

Names have been changed to protect anonymity.

______________________________

Elevation, from VouchedFor, is an insights platform which helps advice firms deliver consistently brilliant client experiences. By analysing over 250,000 clients’ feedback, VouchedFor have identified the factors which make the biggest positive difference to client experience.

The Elevation platform uses carefully engineered questions within a client survey to reveal how advice firms are tracking against these client experience drivers. The insights it offers advice firms help them to drive advocacy from existing clients, improve conversion of prospective clients, and mitigate risk by identifying issues early. It also helps them evidence their commitment to the new Consumer Duty.