We often talk about the importance of knowing your numbers and conversion rates.

Some will be relevant to every business; turnover, gross and net profit margins to name three. Others will be specific to your business. For example, measuring assets under management will be important to some, others, particularly those operating a fixed fee model, couldn’t care less.

When it comes to marketing, the numbers you could track are almost limitless. Conversion rates are some of the most important, yet all too often overlooked.

How do we define conversion rate?

At the highest level, it’s the percentage of all new enquiries which became clients.

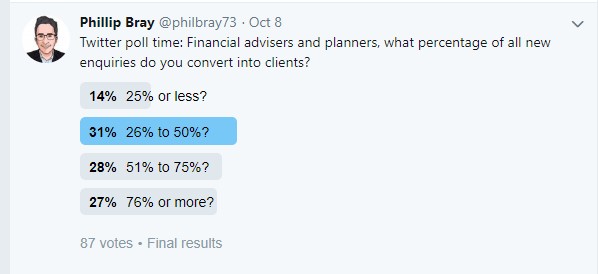

Typically, we see conversion rates of between 10% and 45%. The marketing strategies we build for clients usually assume 25 – 35%, depending on the starting point of the business. Having said that, the results of a recent Twitter poll suggested many advisers and planners generate far higher conversion rates:

The high-level figure only tells us so much and deeper analysis is often needed. For example:

- What was the percentage of all enquiries who attend a first meeting?

- What percentage of first meetings agreed to start the financial planning process?

- What percentage of those became retained clients?

- How does the source of enquiry affect your conversion rate?

Why is understanding your conversion rate important?

In a profession full of numbers, KPIs, metrics and measurements, you might not relish the thought of collecting and analysing yet more data.

But conversion rates are important; improving yours will save time as well as money, ultimately improving profitability.

If your overall conversion rate is low, at say sub 25%, despite high engagement levels once clients are met, one of two things are probably happening:

1. Your marketing is producing the wrong type of new client enquiry

We often see this when the adviser or planner isn’t thinking strategically and hasn’t spent time identifying their target markets. This leads to disjointed marketing, producing enquiries from people you aren’t best placed to help.

Analysis should also be done on the sources of new enquiries to understand which provide the best conversion rates. If referrals and recommendations are more likely to convert than other sources, surely it makes sense to focus on getting more introductions from existing clients?

2. The onboarding (with apologies to our readers who hate the term!) process isn’t as effective as it could be

Examples of where it might be letting you down include:

- Poor data collection, leading to missing information and inaccurate conversion rates

- Slow response rates to new enquiries

- Failing to impress prospects before the first meeting

- An inability to meet the prospect on their timescales

Some firms also have problems converting prospects who attend a first meeting into clients. This is often due to pricing and proposition issues. It’s possible that firms transitioning into financial planners need to update the way they present their new planning proposition.

Improving conversion rates

In our experience, many businesses place too much emphasis on generating new enquiries rather than focusing on improving conversion rates and enquiry quality. This means they consume greater resources and budget creating the higher enquiry levels needed to compensate for low conversion rates.

Far better to think strategically, creating enquiries from people within your target audience, then doing everything possible to convert them into clients. The aim must be to focus on quality, creating the lowest number of enquiries necessary to take on the number of new clients needed.

Doing so will ultimately reduce the amount of time, resources and budget you need to commit to marketing. Consequently, improving your profit margins.

Collecting data

Next week we’ll bring you our top tips for improving the rate at which you convert clients into prospects. Right now though, it’s time to look up your numbers, make an honest assessment of your own conversion rate.