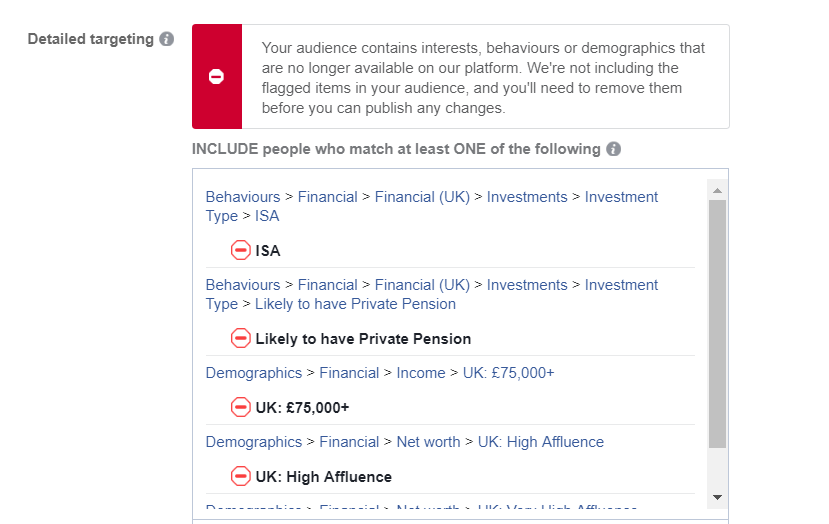

Unfortunately for advisers and planners who use Facebook advertising, Facebook’s Partner Categories are in the process of being removed. All offline demographic and behavioural information, such as home ownership and purchase history, will be axed within the next month.

The only thing left under the category of ‘financial’ for the UK is ‘Pet Insurance: Cat’ and ‘Pet Insurance: Dog’.

Brilliant.

As you may have guessed, this new change is indeed a response to the Cambridge Analytica scandal.

What are Partner Categories?

Admittedly, for advisers and planners who use Facebook advertising, Partner Categories were extremely useful: allowing us, as advertisers, to target certain demographics easily and effectively.

For example, you could previously target people who had a certain level of wealth, an ISA or a personal pension; all facts which were based on empirical data. This data, which Facebook previously acquired through companies such Experian, Acxiom and Oracle Data Cloud, will now no longer be available for advertisers.

As a Facebook user, you might be breathing a sigh of relief.

As an adviser or planner who uses Facebook advertising to acquire new leads, this might cause some initial concern.

If we can’t target using wealth demographics, is there any point in advisers and planners continuing to use Facebook advertising at all?

So, what now?

As with all social media advertising in general, changes such as this usually require nothing more than a little creative thinking.

Those people in your target market absolutely have other statistical characteristics that are still accessible.

There are still many valuable demographics, interests and behaviours you can target:

- Age. For financial advisers and planners, the age demographic is perhaps still the most valuable of all. Most people between the ages of 55 and 65 will thinking about the next stage of life and transitioning into retirement.

- Location. If you’re an adviser or planner who works within a local radius, this targeting function is invaluable. These are the people on your doorstep, after all. Combine a location (ideally no larger than 25km) with a defined age bracket, and something as simple as that may well be enough to engage the right people.

- The Facebook Pixel. This little piece of code is a godsend for advisers and planners who use Facebook advertising. You simply add your Pixel code to your website, which then tracks the people who visit your website and are active on Facebook; allowing you to remarket to them with ads. Those people who got distracted whilst browsing your site don’t have to be lost forever.

- Detailed targeting. Whilst Partner Categories may be gone, there are still valuable demographics and interests that you can utilise in your advertising. These include:

- Industry: If you’re looking to target the wealthy, you could select the industries that are typically related to higher earners, such as ‘business and finance’ and ‘legal services’. Of course, there is a little bit of assumption involved here, so refine this targeting with other categories.

- Parents: Targeting parents (who are helpfully defined by the child’s age, up to teenagers) is still available, which is useful if you’re trying to reach families.

- Personal interests: If you find your clients typically have some common interests, experiment with these. Whether it’s golf or gardening, cruising or camping, it can most likely be targeted.

- Financial interests: The fact remains that ‘personal pension scheme’, ‘retirement’ and ‘pension fund’ are all still targetable interests; though not data-based, they are interests that have been calculated through Facebook users’ interactions with other adverts, pages and links. Whilst they are a little broad, when combined with other targeting categories they will definitely help you reach the right people.

It’s worth noting that none of these targeting categories will work alone: targeting all the 55-65-year olds in London who like golf simply won’t be effective. It’s all about layering and refining your selection until you have a healthy audience size that isn’t too broad. Facebook helpfully displays your potential audience reach as you build your ads.

The end of Partner Categories isn’t the end of Facebook advertising for financial advisers and planners. Sure, you can’t target those who have £75k of annual income, but you can use logical alternatives to build a targeting profile that captures them regardless.

To finish, here are my top three tips for getting the best from your Facebook ads:

- Know your audience. Are they typically married or single? What sort of professions do they have? What do they like to do in their spare time? Only once you know your clients’ habits, interests and demographic profile can you target them effectively.

- Refine, refine, refine. It’s no use trying to target everything and everyone in one advert: people within a 20km of your location who work in the fields of either law or business who have teenage children or toddlers who like golf or travelling and… you get the picture. If you want to target different types of people, use the ‘refine’ function or just create separate ads.

- Review and adjust. It’s no use turning your ads on and leaving them to run. Review them after a week or so: check out the cost per click as well as the types of people who are engaging and adjust your targeting accordingly.

Update: The lack of Partner Categories has by no means impacted the Facebook campaigns we are currently running for our clients. In fact, using ‘interest’-based categories instead of data-based categories have axed cost per lead dramatically. We’re currently achieving less than £1 per lead for some of our clients. Result!

If you would like us to manage your paid social media campaigns, then please get in touch!