The FCA had previously suggested it would reduce the scope of the Register. However, the British Steel debacle caused a swift (and welcome) U-turn with a promise to extend its scope, while making it more user-friendly.

It seems we are now starting to see the first of those changes being rolled out.

What’s changed?

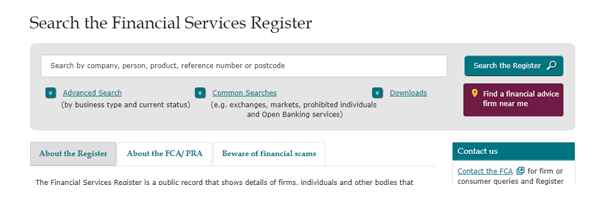

The ability to search for an adviser by location has been added to the Register:

When visitors click the link, a separate window opens. Consumers can then enter their postcode (or location) and narrow their search based on the type of advice they need.

The results are ranked by distance from the location entered.

Is the change good news?

Our original answer was yes. That’s now changed.

A growing number of advisers and planners have reported issues with the results. David Hearne at Satis Asset Management found that on searching his firm’s postcode the first result was that of a clone firm, bearing the same name. This was accompanied by a warning: “Unauthorised. We strongly suggest you avoid dealing with this firm.” The correct listing was fourth on the list. I might be missing something, but why does the FCA see the need to add a separate listing for the cloned firm to the Register?

I can only imagine how frustrated Satis must feel. The misery of dealing with a cloned firm (which they informed the FCA about in the first place) is now compounded by seeing the clone placed higher than their bona fide business on the Register!

At the time of writing, a long thread is developing on the LifeTalk Facebook group, with many more advisers and planners reporting issues. You can read these (after you’ve finished this blog of course!) by clicking here.

There’s another problem too; the language. It’s impenetrable to anyone outside of our profession. The search results include:

- “Appointed Representative” (no explanation was given)

- “Authorised” (probably self-explanatory, but because it occupies the same position on a firm’s listing as “Appointed Representative”, this may cause the consumer to drawn negative conclusions about the authorisation status of an AR)

- “This is a firm or individual that can act on behalf of another firm (its principal) that is authorised in the UK or regulated in another EEA country. The principal is responsible for the appointed representative’s activities. Check with the Authorised Principal that this firm can provide the services you need.” (What? How is consumer supposed to understand that?)

In short, this change is a welcome change, which seems to have been poorly executed and rolled out before it was ready.

An opportunity missed

The Register should be a force for good. The same is true of adviser directories. However, errors and omissions undermine consumer confidence and could lead to decisions based on incorrect information.

Furthermore, with consumers encouraged to search the Register, incorrect information or confusing language may raise suspicions unnecessarily. That could negatively impact a firm’s revenue.

What action should you take?

The first thing to do is head to the Register and check the results of a search based on your postcode.

Now is also a great time to check that your firm’s details on the Register are correct. Too many have private email addresses and missing telephone numbers or website links. If there are errors or omissions on your listing, we recommend fixing these.

Looking forward

Assuming the search facility stays (and the issues ironed out) it’s logical to ask whether it will ultimately become a threat to the commercial directories.

We don’t believe it will. At least not yet.

Unbiased, VouchedFor and AdviserBook dominate the directory market. All three are commercial enterprises; although it should be noted that AdviserBook does not currently charge a membership fee.

They fill a gap left by the regulator and other bodies. Despite criticism from some, they do a good job in connecting consumers with advisers and planners. That’s in part because they invest in advertising and promotion. To be a threat to the commercial directories, the FCA will have to do the same.

Consumers will only use the Register if they are aware of it and the results are useful to them. This means the FCA must publicise the Register, remove the jargon, and include factors to differentiate individual firms.

So what next?

I wrote an article for Adviser Lounge back in July in which I highlighted the need for accuracy.

I concluded by saying: “When it is launched, the new Register will have journalists, as well as advisers and planners, crawling all over it. If they find inaccuracies it will immediately undermine the new directory’s credibility and further erode trust. It’s essential that the new register is trusted from day one. That means it must be accurate and up to date, so let’s keep it simple to start with, building a firm foundation before we aim for something more ambitious, as I believe we should.”

Sadly, that prediction seems to be coming true.

By acting quickly, the FCA might be able to repair the damage. After the British Steel debacle consumers deserve better and given the fees they pay, so do advisers and planners. Contact us for more information.